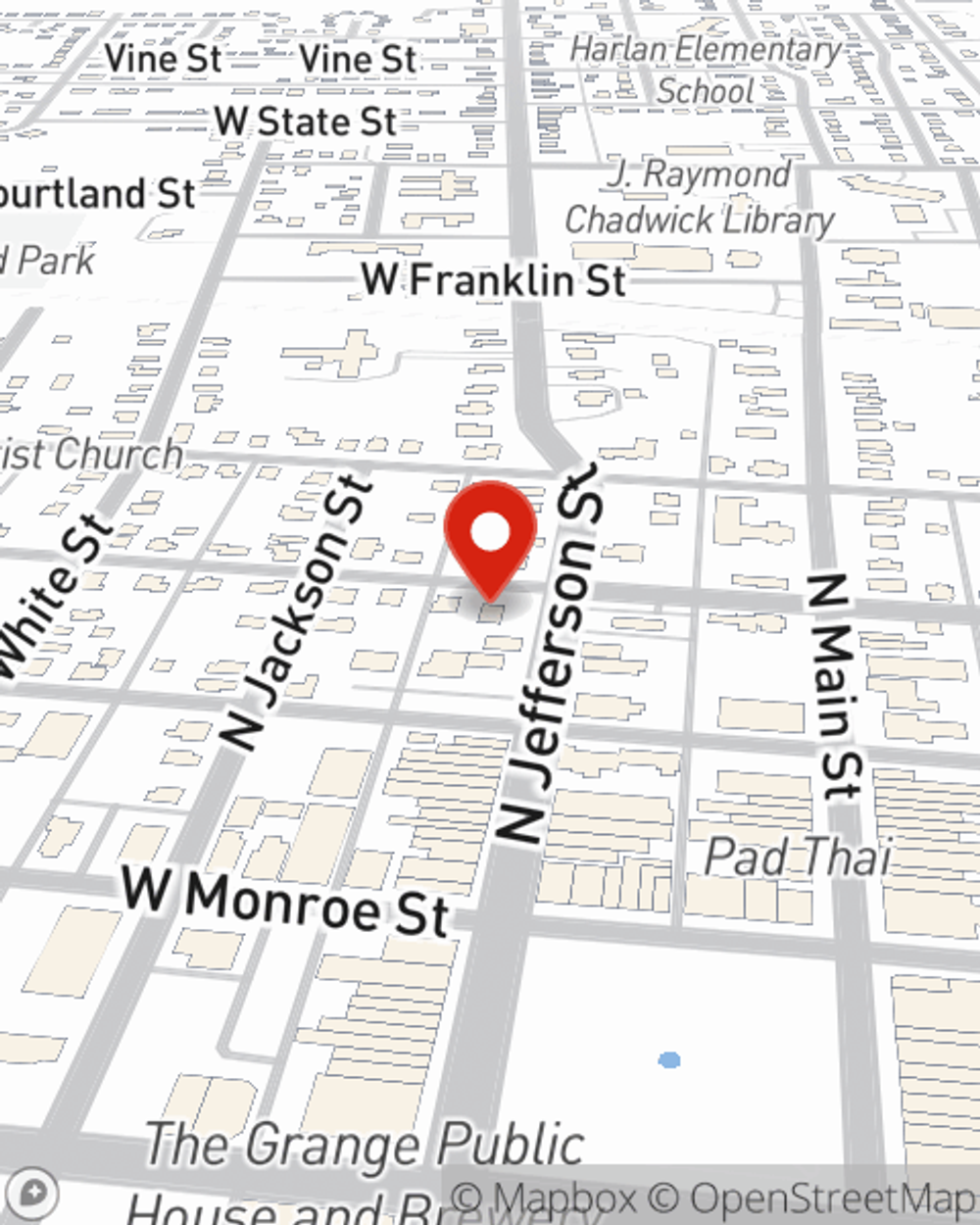

Life Insurance in and around Mt Pleasant

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It can be what keeps you going every day to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can maintain a current standard of living and/or keep paying for your home as they mourn your loss.

Protection for those you care about

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Fortunately, State Farm offers numerous policy choices that can be modified to correspond with the needs of your loved ones and their unique situation. Agent Anne Davidson has the personal attention and service you're looking for to help you select a policy which can assist your loved ones in the wake of loss.

State Farm offers a great option for someone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Anne Davidson, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Anne at (319) 986-5433 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Anne Davidson

State Farm® Insurance AgentSimple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.